When interviewing an association property manager, the first question HOA board members usually ask is, "So what will this cost?" While your association's budget is essential, looking at a price tag out of context will likely set you up with a manager that won't be the right fit. A better approach is to think of hiring an HOA manager as an investment over time, comparing costs to the value you may get and the overall long-term impact you want to see on your community.

What are HOA Management Fees?

HOA management fees are charges levied by property management companies to oversee the day-to-day operations of homeowners associations (HOAs). These fees cover a range of services, including financial management, administrative support, maintenance coordination, and resident communication.

Typically calculated on a per-unit or per-home basis, HOA management fees fund the maintenance of the functionality and appeal of community living spaces. They enable HOA boards to delegate tasks efficiently and provide residents with the services and amenities they expect.

What Do HOA Management Fees Cover?

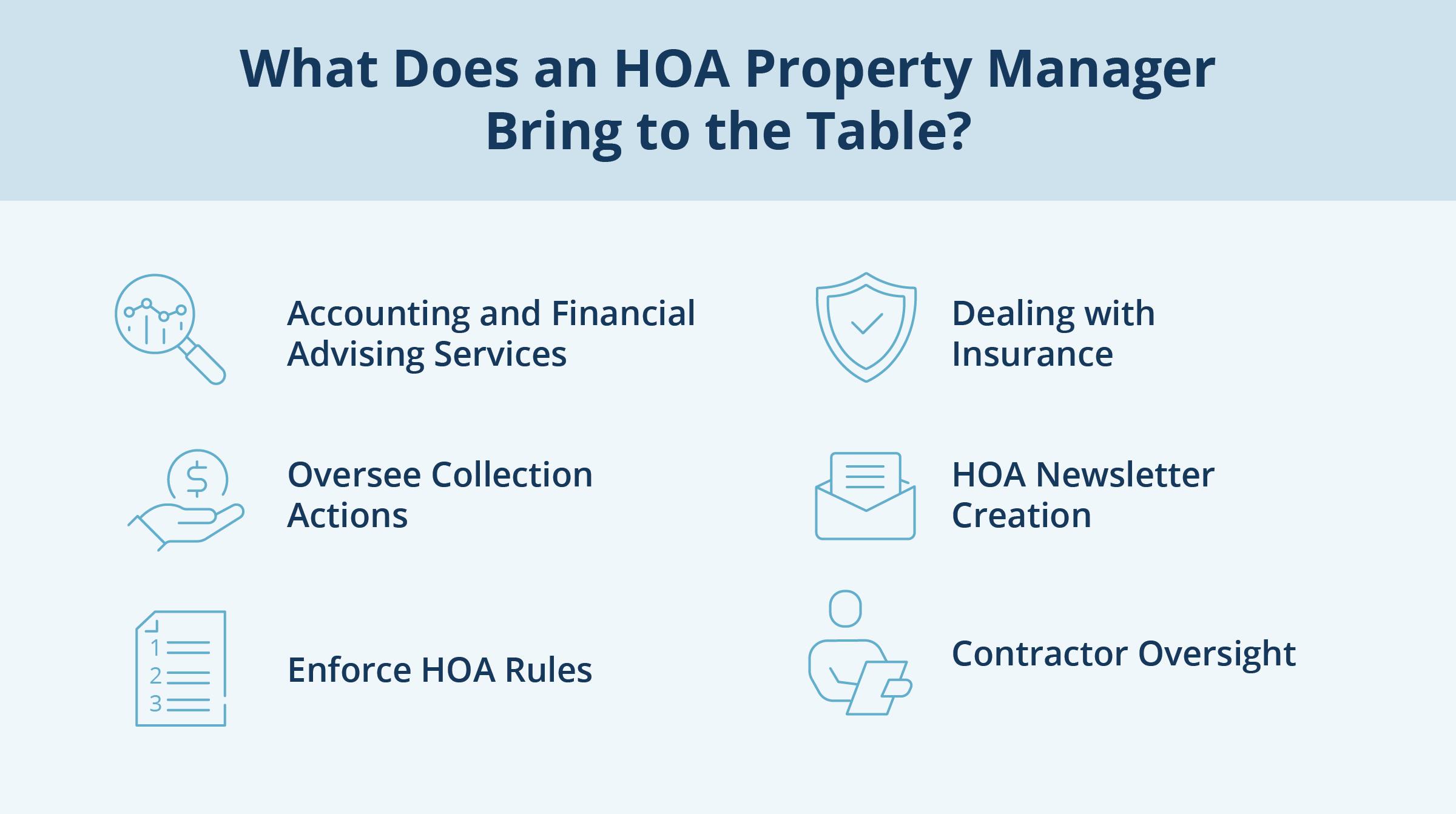

When searching for the perfect HOA manager, there are certain skills you want to look out for. Understanding the scope of these services and the typical HOA fees is essential for making informed decisions regarding your HOA's financial planning and operations.

1. Accounting and Financial Advising Services

One of the primary responsibilities of an HOA manager is to handle accounting and financial advising services. This includes tasks such as bookkeeping, budget planning, and financial reporting. The manager may suggest how much to budget for future costs, anticipate maintenance needs for common properties, and provide guidance on finding reputable contractors. For example, they can help with estimating the budget for regular repairs, landscaping services, or improvements to community amenities.

2. Oversee Collection Actions

HOA managers play a vital role in overseeing collection actions. Their professionalism and impartiality as non-residents of the community can be beneficial in handling delicate matters such as preparing notices of delinquent assessments or enforcing late fees. For instance, part of their role may include communicating with homeowners regarding outstanding payments, and initiating necessary legal actions if needed—a delicate task that benefits greatly from the expertise of an association manager.

3. Enforce HOA Rules

Enforcing community rules is another responsibility well-suited for HOA managers. They act as mediators and enforcers of the HOA's governing documents. This can include addressing violations, issuing warnings or fines, and ensuring compliance with architectural guidelines. For example, the manager will often handle situations like towing improperly parked vehicles or removing items left on common property violating the rules.

4. Dealing with Insurance

HOA managers often deal with insurance-related matters on behalf of the association. While this is not a regularly required activity, it is crucial to have someone knowledgeable handling insurance claims when needed. For instance, if the community experiences damage due to a natural disaster, the manager can guide the board through the insurance claim process, coordinate with adjusters, and ensure the HOA receives appropriate coverage.

5. HOA Newsletter Creation

Many HOAs have regular communication channels with residents, such as newsletters or community updates. Property managers can create and distribute these documents on behalf of the HOA. They can take care of content creation, design, printing, and related costs. Newsletters can be a valuable tool for sharing important community information, upcoming events, and policy reminders.

6. Contractor Oversight

When it comes to property maintenance, HOA managers often oversee contractors hired to perform various tasks. They act as the point of contact, ensuring the work is completed satisfactorily, within budget, and according to the agreed-upon timeline. For example, if the HOA decides to repaint the community clubhouse or repair a pool, the manager will coordinate with contractors, obtain competitive bids, and oversee the project's progress.

Different Levels of Service to Consider When Examining HOA Management Fees

As you navigate the crucial task of selecting a property management solution for your HOA, explore various options tailored to your community's specific needs. Consider three primary types of property management: full service, remote, and consulting.

Full-service management provides comprehensive support, handling day-to-day operations, financial matters, and maintenance tasks.

Remote management offers flexibility with online tools and remote communication while consulting services provide expert guidance and support to your existing board.

Consulting management focuses on strategic planning, decision-making, and optimizing property management processes. With consulting management, you can tap into industry expertise to enhance operational efficiency, streamline workflows, and implement best practices tailored to your property management needs.

When evaluating potential managers, look for essential skills such as effective communication, financial expertise, and knowledge of local regulations. Moreover, take a moment to ponder whether a specific task truly requires direct board involvement or could be handled solely by a skilled HOA manager. Making an informed decision ensures that your community thrives under capable leadership.

How Much are HOA Management Fees?

HOA management fees vary depending on factors such as community size, location, amenities, and desired service level. On average, these fees can range from $100 to $500 per month per home or unit.

Larger communities with extensive amenities may incur higher fees due to increased operational complexity, while smaller communities may pay less. Additionally, management companies may offer tiered pricing structures based on the level of service required. HOA boards must carefully consider these factors when budgeting for management fees to be sure they receive the necessary services at a fair cost.

Generally, there are no set fees, and typical HOA fees vary widely from company to company. However, for some activities, HOA property management fees may be regulated to some extent by state laws, allowing your association to look up the limits.

Some firms offer different combinations of services or may allow HOAs to select from the list of their offerings to determine what functions a property manager will perform. The choices made may depend on how active the HOA and community are, the size of the community, and the level of knowledge and experience the HOA members have.

Here are the top three types of typical HOA property management fees:

- Initiation Fees: This is the initial fee to take over day-to-day management of the HOA and can vary based on the workload required. For instance, a small HOA might have an initiation fee ranging from a couple of thousand dollars, while larger HOAs with several hundred homes might incur payments of $30,000 or more.

- Ongoing HOA Management Fees: These are the most common monthly fees the HOA pays the management company. The cost is typically pre-negotiated. Larger communities may enjoy lower rates due to scaling administrative efforts, while areas with a higher cost of living may have higher fees.

- Exit Fees: If your HOA is switching from one management company to another, exit fees may apply to facilitate a smooth transition. While it is important to expect and compensate the manager for their service, the specifics of exit fees should be discussed and agreed upon before making any changes.

What Factors Affect HOA Management Fees?

Understanding the factors that influence management fees enables HOA boards to effectively budget and make decisions. HOA management fees are influenced by various factors, but three main factors should be considered.

Size of the Community

Larger communities typically require more extensive management services, including financial oversight, administrative support, and maintenance coordination, which can result in higher fees. Conversely, smaller communities may have lower fees due to their simpler operational needs.

Management Services Provided

The scope of services provided by the management company also plays a role in determining fees. Communities with additional amenities such as swimming pools, tennis courts, or landscaping services may incur higher fees to cover the maintenance and management of these facilities.

Location of the Community

Furthermore, the location of the community can significantly impact management fees. Areas with higher costs of living and labor rates generally have higher management fees to compensate for these expenses. Conversely, communities located in more affordable areas may benefit from lower management fees.

Evaluating HOA Management Fees

Hiring an HOA property management company is an important decision, and should be based on more than just price. Remember that the cheapest option may not always provide the necessary value. Hiring the right HOA property manager is an investment that can save time and provide peace of mind knowing professionals oversee and guide your HOA's operations.