Going from a typical 9-to-5 to becoming a residential real estate investment pro is, unfortunately, not as easy as one, two, three. And managing residential properties alongside a traditional job? Definitely not a simple task.

Even so, having the ambition and creativity to make it can result in a rewarding venture. If you’re ready to dig your heels in, this guide will help you take the right first steps, saving you time now and earning you more money in the future.

Getting Started in Residential Real Estate Investment

Investing in residential real estate can be a high-reward way to build wealth. There are countless ways to get started in real estate, including low-effort, passive investments like buying into REITs or renting with the help of a property manager, as well as active options like managing short-term vacation rentals or becoming a landlord. You can even get creative with ancillary income through mini-businesses within a commercial building or low-density multi-family complex.

But, before borrowing hundreds of thousands of dollars to bankroll your real estate investment dreams, let's dig a little deeper into some key areas you need to understand.

Know the Investment Lingo

Understanding basic residential real estate investment concepts and definitions is crucial for buying, owning, and renting residential properties. Purchasing property requires a sizable investment, but with proper knowledge, you can generate passive income from rent while allowing the property to appreciate in value.

There are a lot of terms to cover, from appraisal to building classifications, loan-to-value (LTV) ratios, REITs, and amortization. This comprehensive real estate terms and definitions list details almost any term you'll come across and provides essential knowledge of common real estate investing terms.

Commercial Real Estate vs. Residential Real Estate

While this guide's focus is residential real estate, understanding the differences between investing in residential real estate and commercial real estate will deepen knowledge of the overall industry.

Simply put, residential real estate includes properties such as single-family homes, apartments, and condominiums intended for individuals and families to live in. Residential real estate investors generate income primarily through rental payments from tenants. Initially, residential investments have lower upfront costs and management requirements but, over the long term, offer more modest rental yields compared to larger commercial properties.

Commercial real estate, on the other hand, includes properties like office buildings, retail spaces, industrial warehouses, and hotels designed for business purposes. While requiring higher upfront capital, commercial investors generate income through leases or rents paid by businesses and offer higher rental yields and longer lease terms than residential properties.

Key Differences:

- Investment Size: Commercial real estate is a more substantial investment than residential real estate properties, as commercial properties are used to house businesses, requiring more space than residential properties.

- Return Potential: Commercial real estate investments could potentially generate higher returns than residential real estate investments since commercial properties can command higher rents than residential properties.

- Investment Horizon: While commercial properties generally offer higher rental yields, they require larger initial investments. Commercial real estate investors have a longer investment horizon than residential real estate investors because it takes longer to find and acquire commercial properties, lease units, and generate income.

- Management Complexity: Managing commercial properties requires more management than residential real estate due to a higher volume of tenants with more diverse management needs.

- Market Factors: Residential real estate and commercial real estate fluctuate based on different market factors. While residential real estate depends on housing market dynamics, commercial real estate fluctuates based on economic and business trends.

- Risk Profile: Compared to residential properties, commercial investments often involve higher risks and rewards. Higher potential income is available, but commercial properties are more susceptible to changes in the economy and the market.

- Diversification: Long-term real estate investors often diversify their portfolios by investing in both residential and commercial properties to spread risk and boost potential monetary rewards.

For beginner investors, residential real estate is often considered a more accessible entry point due to lower barriers to entry and management simplicity. Commercial real estate, while it can offer high returns, is significantly more complex. The choice between residential and commercial real estate depends on many factors, including the investor's financial capacity, risk tolerance, and investment goals.

Rental Property Trends To Be Aware Of

Staying up to date with current rental property trends is becoming increasingly important for investors. Across the country and world, demographics are changing (as reflected in Buildium's 2023 Industry Report), with fewer one-person households and single-parent family renters. Because of this, landlords can expect an increase in couples with kids and multi-generational households. This development is likely linked to economic pressures caused by the pandemic and recession and has multifaceted implications for landlords.

Millennial renters are also on the rise, seeking more space to expand their families. Smart landlords must consider accommodating changing renter priorities in their properties.

Geographically, the market is shifting from urban areas to suburban areas, with over two-thirds of respondents residing in suburban and rural areas. This shift is partially fueled by increased remote work opportunities and the growing number of individuals working from home.

Additionally, financial trends are crucial for landlords to grasp, as the general level of income in the U.S. has increased over the past couple of decades. At first glance, this seems to indicate that individuals have increased buying power rather than leaning on renting property. However, inflation often waters down the benefits of rising wages, making the rental market highly competitive.

On top of the pressures of inflation, rent affordability has worsened, with 24% of families spending more than half their income on rent. To protect profits while serving their community, landlords must understand how inflation, increased wages, and the cost of living are evolving in their local area.

Another trend to consider is the rise in employment, which translates into lower moving rates for rental property owners. Perhaps surprisingly, this is positive news for landlords because if you can find great tenants, you'll likely be able to keep them for a few years. Renter expectations are also changing, with a 26 percentage point increase in renters preferring to pay their rent electronically since 2021.

One of the most important trends on the rise? Landlords working with property managers. The partnership between landlords and property managers leads to less stress in three key areas:

- Handling administrative tasks, including bookkeeping and paperwork

- Finding high-quality renters

- Successfully marketing their property in a competitive market

To find the right fit, landlords should find a quality property manager in their area.

To learn more, explore our detailed guides on specific property types:

Real Estate Investment Calculator: Determine the Profitability of Different Properties

While you may be ready to maximize profits and minimize debt, growing a real estate investment empire isn’t quite as simple as that. Many disparate factors, such as what kind of loans you’re eligible for, credit history, and liquidity of your assets, work together to determine what would be a wise investment for you.

To this end, we’ve built a real estate investment calculator to assist in analyzing the value of purchasing an investment property or renting your home or condo.

Pop your information into the calculator’s boxes to instantly calculate the ROI, cash flow, and IRR. If your situation or strategy changes, you can adjust any of the inputs, and the results will instantly update to reflect the new calculations.

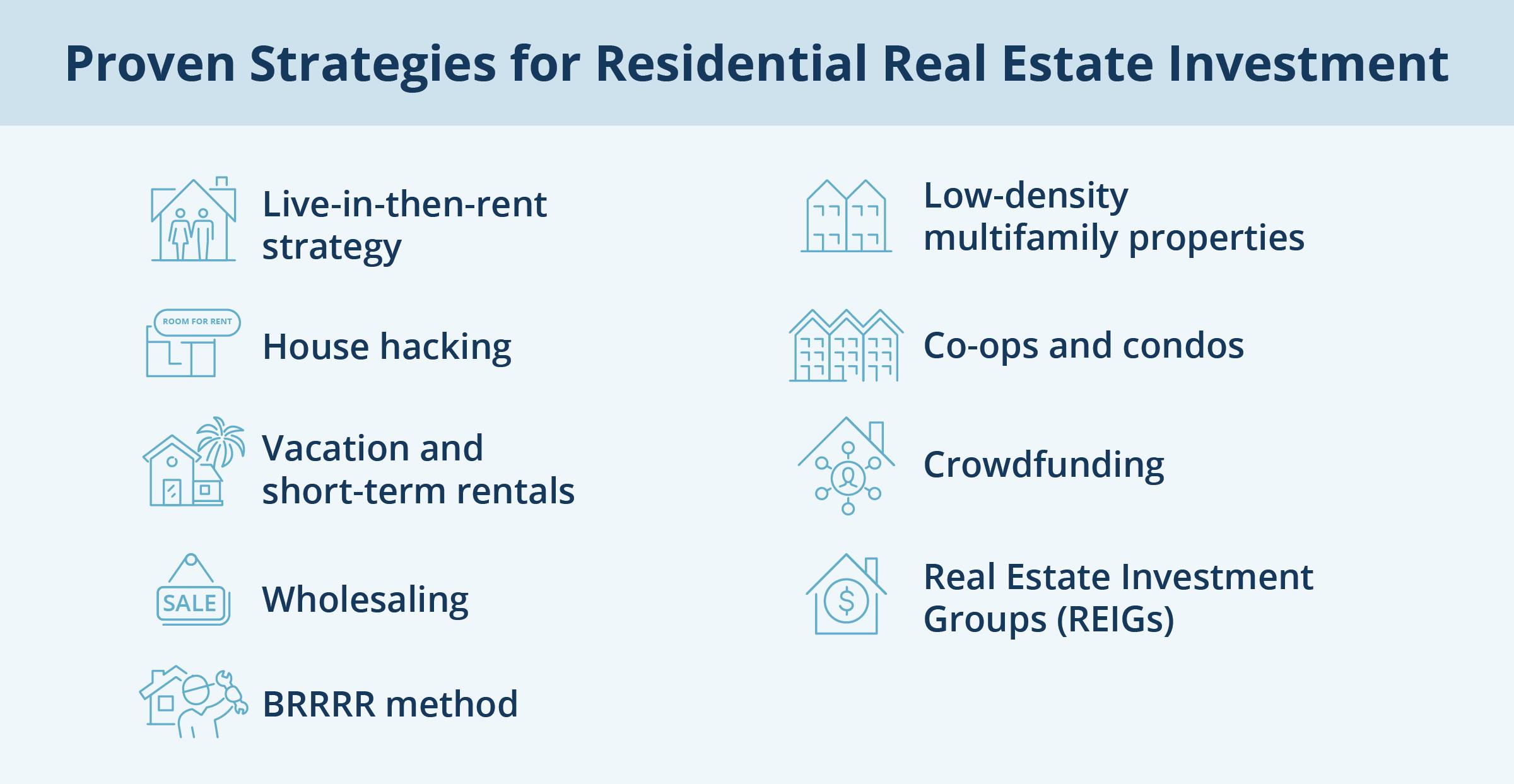

Proven Strategies for Residential Real Estate Investment

There are countless strategies for successful real estate investing. For example, the "live-in-then-rent strategy" is where property owners live in the property before renting it out, allowing investors to gain intimate knowledge of the property's condition and unique attributes for more informed decision-making and, hopefully, a smooth transition to landlord status.

Another option is house hacking, which capitalizes on unused space within a property to generate income to cover mortgage costs.

Vacation and short-term rentals are other widespread strategies, especially in today's sharing economy, but they come with challenges like managing guest turnover, adhering to local regulations, and navigating market fluctuations.

Another popular approach? Wholesaling. This option facilitates accelerated financial gains, but as it requires market knowledge, negotiation expertise, and navigating competition for profitability, it can be difficult to succeed on your own.

A long-term favorite is the BRRRR Method, which combines value enhancement with long-term gains, while single-family investing offers manageable sizes and a broad tenant base.

If you're really ambitious, low-density multifamily properties offer a balance of manageable scale and potential revenue. Or consider co-ops and condos, which offer unique investment opportunities, although investors must understand their distinctions and financial goals.

Not ready to buy a whole house or property? Not a problem. Crowdfunding offers collective ownership of properties, and Real Estate Investment Groups (REIGs) provide passive income without daily management responsibilities. These options are great additions to traditional real estate investing or side investments alongside your landlord duties.

Get creative. Think outside the box. There's no one, set-in-stone way to succeed in real estate.

Residential Real Estate Management: How To Get Started

While residential real estate is packed with possibilities, it requires careful planning and management. Whether you're a seasoned investor or just starting out, these five simple steps can guide the process of successful residential real estate management.

Step 1: Hire a Professional Property Manager

By starting with hiring a professional property manager, you'll skip most of the headaches of owning and renting residential real estate. Property managers bring expertise and a range of services that can make your investment journey smoother and more profitable. They’ll be able to take care of day-to-day management, work with vendors and tenants, and conduct regular maintenance and repairs as needed.

Property managers also negotiate and manage contracts, handle legal matters, and utilize technology for efficient property management. Additionally, property managers provide access to a network of reliable contractors and offer on-site expertise for investors living in different states or countries.

Step 2: Prepare Your Property for Renters

Before welcoming tenants into their new home, the property must be in top condition. Depending on the state of the property at the time of purchase, this can involve conducting necessary renovations and updates to ensure the property meets modern standards and tenant tastes. Also, you’ll need to ensure everything on the property is in compliance with local laws and regulations, set competitive rental rates, and create a marketing plan to attract tenants.

Step 3: Find the Right Tenants

Choosing the right tenants is crucial to a successful real estate investment. And finding the ideal tenants is no simple task. Begin with a detailed and professional application form, then screen applicants thoroughly, including conducting background checks and verifying references. Once selected, set clear tenant criteria, create comprehensive rental agreements, and implement efficient rent collection through technology like electronic payment portals, so there aren't any delays in cash flow.

Step 4: Maintain Your Rental Property

Of course, a residential real estate investor’s job isn't finished after handing over the keys. At that point, you become a landlord, which means maintenance of rental properties is an ongoing responsibility that directly impacts investment profitability.

Key maintenance tasks include conducting regular inspections to identify and address issues promptly, handling repairs and maintenance efficiently, and keeping the property safe and habitable. Additionally, you must balance compliance with safety codes and regulations while managing tenant requests and concerns effectively.

Step 5: Keep a Pulse on Your ROI

Ultimately, the success of residential real estate investment hinges on the ability to manage ROI (return on investment) effectively. To do this, you or your property manager must keep meticulous financial records, monitor rental income and expenses, and adjust rental rates as needed. Simultaneously, you need a plan for contingencies and unexpected expenses while continuously assessing the performance of your investment.

Closely following these five steps will help you carve a pathway toward successful residential real estate management.

How to Get the Most ROI From Your Residential Real Estate Investment

Landlords can take advantage of countless strategies to maximize return on investment (ROI) from residential investment properties. Many successful property owners prioritize providing tenants with the amenities they want, such as location, neighborhood character, crime rate, and nearby attractions. A common multi-unit strategy is to update units quickly between vacancies with aesthetic amenities like hardwood flooring, modern countertops, and extra storage, keeping vacancies low and housing up-to-date.

Speaking of vacancies, another tactic to keep revenue high is to conduct proper interviews and screening when searching for tenants in order to minimize vacancies. Finding a tenant with a history of stability beyond basic income and credit score criteria is vital to your real estate business. Plus, scheduling regular maintenance, such as inspections and repairs, can inspire renters to stay and save you some money in the long run.

Expanding Your Residential Real Estate Investment

Once you've got your real estate investment property (or properties) up and running, you'll likely be looking for ways to expand your investments and income.

Investors typically pick one of two strategies to do this: either improve an existing investment or expand investments through buying similar properties to reduce risk or different properties to diversify risk and reduce exposure in one market. Both approaches can help you maximize returns, manage risks, and enhance your overall real estate portfolio.

Improve Existing Property

While ongoing maintenance is necessary in any real estate venture, investors should also be intentional about property improvements to boost income over time using the following strategies:

- Renovations and Upgrades: Enhancing existing property can increase its value and rental income potential. High-reward renovations include updating kitchens and bathrooms, improving energy efficiency, or adding amenities like a washer and dryer.

- Maintenance: Is your maintenance management up to scratch? Regular maintenance is crucial to protecting your investment. Conduct inspections and address issues promptly to maintain the property's condition and keep tenants satisfied.

- Property Management: Want to make room to expand your investments? Take some onerous tasks off your plate. Efficient property management can streamline operations and reduce costs. Hiring a professional property manager to handle day-to-day tasks, tenant relations, and maintenance frees up time to investigate other streams of income.

- Rent Increases: Inflation is the name of the game. Regularly evaluate the rental market in your area and adjust rents accordingly. Incremental rent increases over time can boost your income while keeping you competitive.

- Expand Rental Services: Explore additional services that can increase income, such as offering furnished units, including utilities in the rent, or providing access to amenities like a gym or laundry facilities.

Find New Investments

There are countless ways to find new investments, whether by networking with other real estate investors, attending real estate investment seminars, partnering with a property manager or real estate investment advisor, or doing online research. Typically, you'll come across the following suggestions for expanding real estate investments:

- Diversify Property Types: Consider diversifying your real estate portfolio by investing in different types of residential properties. For example, you might explore single-family homes, multi-family units, or condominiums to spread risk.

- Explore Different Locations: Expanding into new geographic areas or neighborhoods can provide access to diverse rental markets. Areas with strong growth potential or underserved rental demand both offer lots of opportunity.

- Investment Partnerships: No need to go it alone! Collaborate with other investors or join a real estate investment group to access larger and more diverse properties that may be outside your individual investment capacity.

- Consider Commercial Properties: While it's simplest to start with residential real estate after you're confident in that market, you might explore commercial properties such as office spaces, retail centers, or industrial properties for diversification.

- Real Estate Investment Trusts (REITs): REITs offer an indirect and passive way to diversify your real estate portfolio. They provide diversification without direct property ownership, allowing you to invest in various properties across different sectors.

- Research Emerging Trends: Stand still, and your investment will stagnate. Stay informed about emerging trends in real estate, and you'll go far. Explore ideas like short-term rentals, co-living spaces, or sustainable properties, and assess whether they align with your investment goals.

A few additional tips when diversifying your real estate portfolio:

- Consider investment goals: When diversifying your real estate portfolio, it is critical to consider overall investment goals. Are you looking to generate passive income? Build equity? Invest for the long term? With concrete goals in mind, you will choose investments that are most likely to help you achieve them.

- Consider your risk tolerance: Your risk tolerance is also an essential factor to consider when diversifying your real estate portfolio. Risk-averse? Focus on less risky investments, such as residential real estate in stable markets. If you are more risk-tolerant, you may consider more risky investments, such as commercial real estate or emerging markets.

- Rebalance your portfolio regularly: As your investment goals and risk tolerance change, you will need to rebalance your portfolio, which can mean selling some investments and buying others to ensure that your portfolio remains aligned with your goals.

Diversification with these strategies helps mitigate risks associated with market fluctuation and property-specific challenges. By allowing you to tap into various income streams and capitalize on opportunities in different segments of the market, diversifying your real estate portfolio reduces risk and improves your chances of success.

Associations, Communities, and Resources To Know

As residential real estate is a complex and risky endeavor, those beginning the journey should endeavor to find education and support along the way.

Two highly beneficial resources for up-and-coming residential property investors are Real Estate Investor Association Groups and the National REIA. Offering a broad range of resources, including educational courses, networking opportunities, and access to capital, these organizations have a lot to offer both new and established investors.

Real Estate Investor Association Groups are local organizations that connect real estate investors with each other and with resources in their community. They provide access to a range of high-quality educational programs, including classes on how to find deals, finance your investments, and manage your properties. Plus, they host networking events as an opportunity for investors to meet each other and learn from shared experiences.

The National REIA is a nationwide organization that provides resources to real estate investors across the country. They also offer educational programs, including online courses and live events, and access to capital through their investment fund.

If you're new to real estate or interested in growing your business over the years, connecting with these types of organizations can be extremely beneficial. Joining a real estate investor organization may be the ticket to the education and support you need to succeed.

Other online resources, such as Nolo, can help you easily find legal and compliance information you need.

Residential Real Estate Investment FAQs

As you progress on your real estate investment journey, remember there are no wrong questions. In fact, you likely have similar queries to others on the same journey, so we’ve compiled this list to answer your most burning residential real estate inquiries:

How do you get started in real estate investment?

Good news! You're in the perfect place to build your residential real estate knowledge. Apart from this article, our blog, and resource database, search out ways to further educate yourself about the market, set clear financial goals, secure financing, and consider starting with a single property to gain experience. An organization such as The National REIA, can often provide the needed support to get started.

What are the investment benefits of different property types?

Property types like residential homes or small multi-family units can offer stable and predictable monthly rental income, while commercial properties have the possibility to yield higher returns but may require greater financial risk and management complexities.

How can I find the right property?

After identifying locations with strong growth potential, researching market trends, analyzing property conditions, and calculating potential cash flow, you should be well-equipped to make the perfect decision for your real estate goals. Local experts, including property managers and other real estate professionals, can help point you in the right direction.

What goes into managing a rental property?

Rental property management involves a multitude of daily, weekly, and annual tasks such as tenant screening, maintenance, rent collection, and legal compliance to ensure smooth operations and income generation. Excellent residential property management—and tenant retention—requires high levels of competence in organization, communication, and people skills.

Where can I find help?

It's no secret that residential real estate can mean a lot of organization and hands-on management. But there are answers for those who seek help. Property management companies and online landlord software solutions offer tools to streamline tasks and can provide professional guidance.

Find an Expert To Help You Make the Best Investment

If you’re looking to grow your residential real estate investment in a sustainable and profitable way, the most efficient—and cost-effective—action to take is to work with a professional. Professional property managers bring a lot to the table and, in return, take a lot of onerous tasks off your plate.

Ready to find the perfect property manager for you? Let us help.